Money Smarts for Adults

Here are some helpful resources to teach you about credit scores, budgeting, home buying and retirement planning.

What’s Your Money Style? – It’s helpful to understand how you and the people around you think about money.

Financial Literacy Webinar Recordings | Get financial insights from some of Madison’s leading experts in the industry. Listen to episodes, read key takeaways, and contact the speakers from our recent Financial Literacy webinar series. Topics: Cyber Security, Estate Planning, Home Buying Guide, Investing, and Retirement Planning.

Financial Literacy Webinar Recordings | Get financial insights from some of Madison’s leading experts in the industry. Listen to episodes, read key takeaways, and contact the speakers from our recent Financial Literacy webinar series. Topics: Cyber Security, Estate Planning, Home Buying Guide, Investing, and Retirement Planning.

Balance Financial Counseling | As an MCU member you can receive free financial counseling through BALANCE. Get personalized budgeting help, review your credit report, prepare for buying a home, obtain identity theft solutions and more.

Balance Financial Counseling | As an MCU member you can receive free financial counseling through BALANCE. Get personalized budgeting help, review your credit report, prepare for buying a home, obtain identity theft solutions and more.

Just tell them Madison Credit Union sent you!

BALANCE is a trusted financial counseling institution with over 45 years promoting financial wellness.

Click here to the BALANCE page or call now to get started: 888-456-2227.

Budget & Goals | Knowing where your money goes and where you want it to go for you in the future is a great place to get started on the road to financial freedom.

Budget & Goals | Knowing where your money goes and where you want it to go for you in the future is a great place to get started on the road to financial freedom.

Check out our article on Simplifying your Budget with 4 Minimalist Techniques and download our Financial Goals and Budget Worksheet here.

Download our Bill Payment Calendar here.

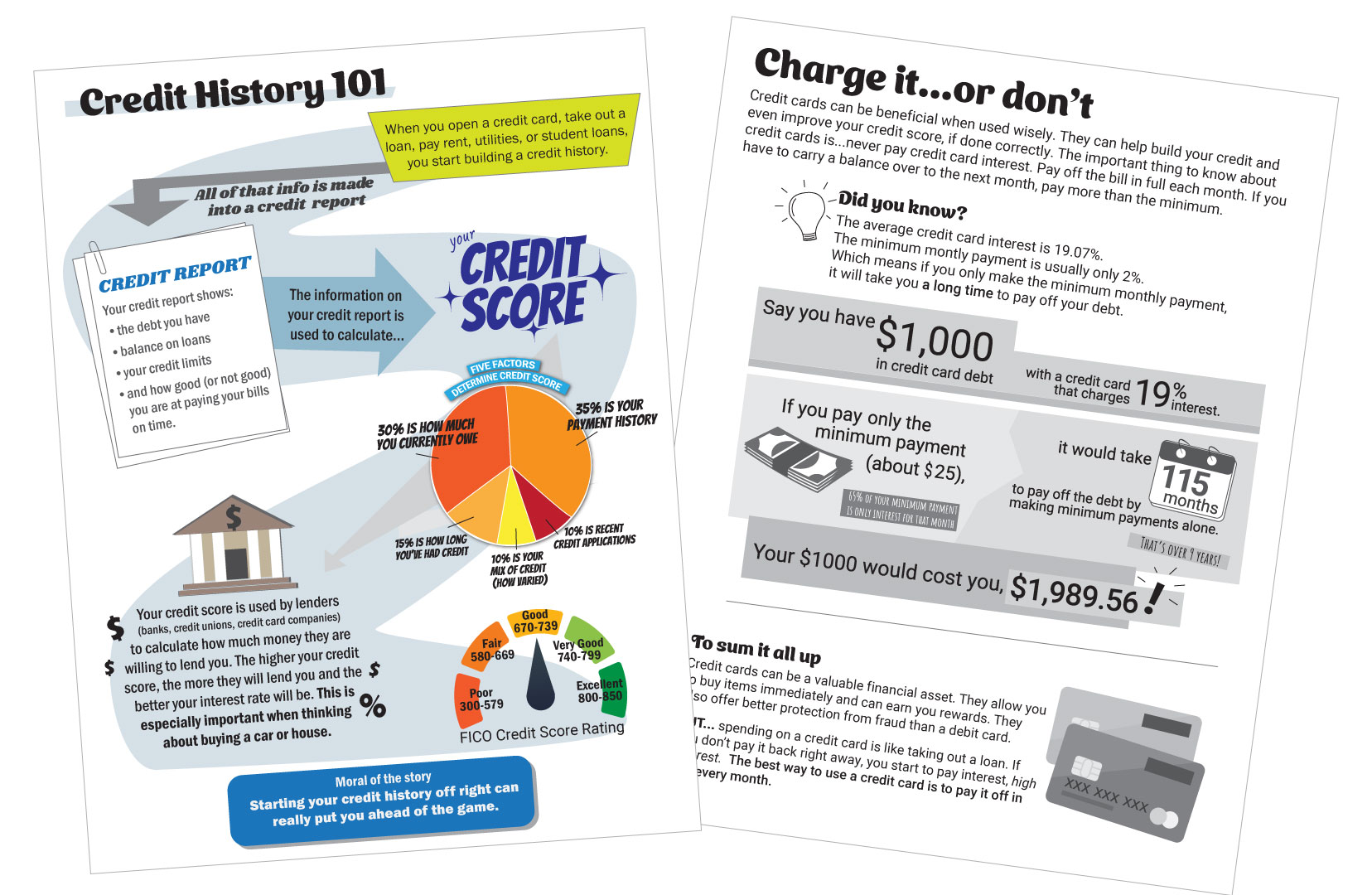

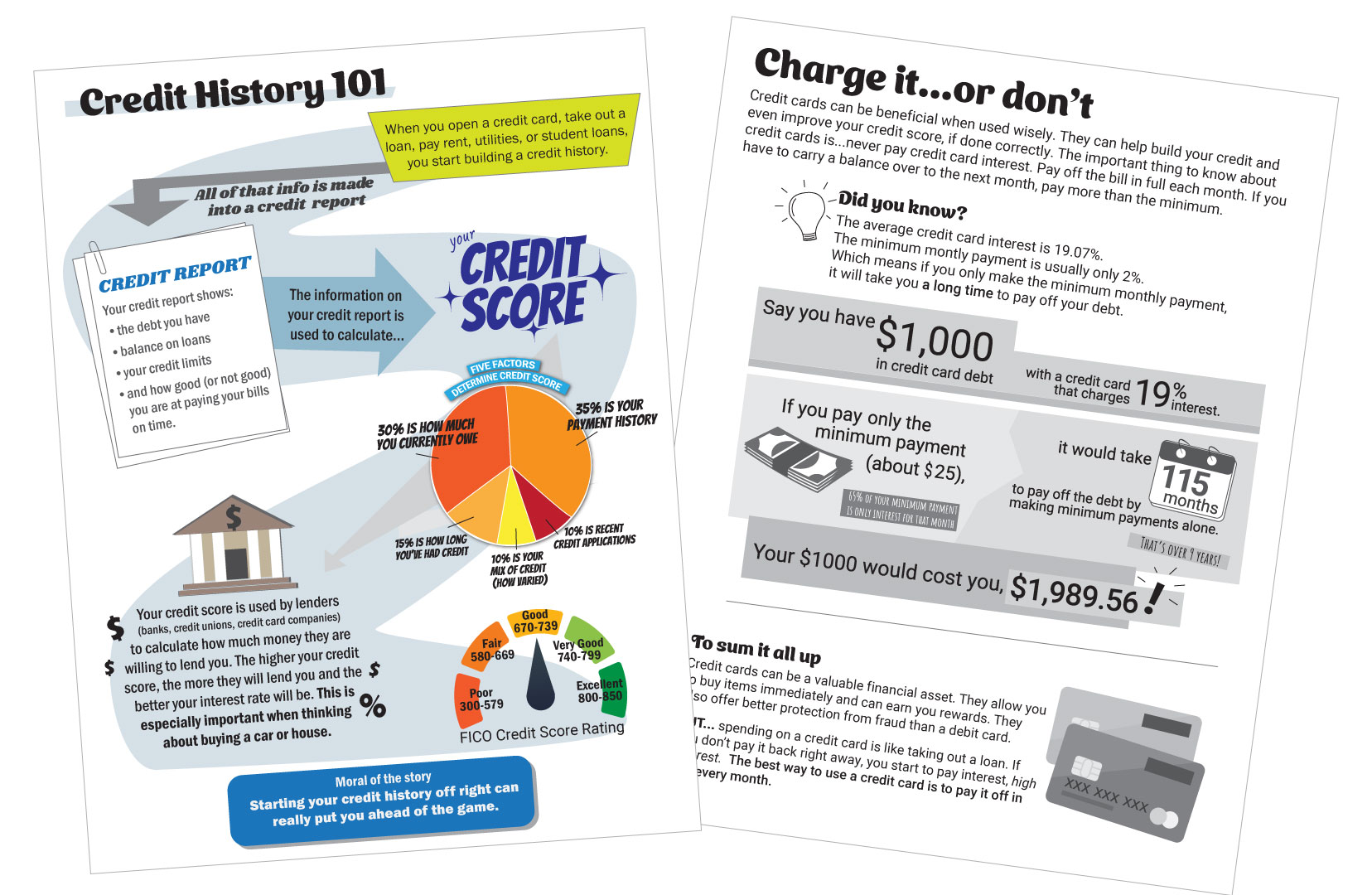

Credit Scores | Everything you need to know about your credit report and credit score.

Credit Scores | Everything you need to know about your credit report and credit score.

Check out our article 7 Tips for a Healthy Credit Score.

Retirement | Plan for your golden years with these helpful tools and articles.

Pre-Retirees: Avoid These 5 Real Estate Mistakes Getting ready to retire? Thinking about downsizing, refinancing or buying a second property? Read these 5 real estate mistakes to avoid first.

How to choose a retirement plan that works for you. This article includes all the ins and outs of a 401(k), IRA and Roth IRA.

Additional Retirement Links:

Retirement Calculator – Know how much you have to save to live how you want.

More from the IRS on Required Minimum Distributions (RMDs) – Know when and how much you need to remove from different retirement accounts.

Play the Money Game | Learn while you play with this FDIC interactive game to help you learn about everyday financial topics. Click a topic below to go to the game.

Here are a few more financial tip articles. Click here to see a full list of Financial Education Blog Posts.

Money Smarts for Young Adults

Start your finances out on the right foot with these helpful resources

Off to College | How to choose a career path, pick a school, and pay for it

Step 1: Choose a Career Path

You can save a lot of money and time by knowing what you “want to be when you grow up” before heading into college. If you don’t already have an idea, here are some tips to get you started:

- Make a list of your skills and strengths

- What previous working experiences have you enjoyed? What was it about them that you enjoyed (helping others, being social, etc.)?

- Don’t have any experience? Get an internship in a field of your interest.

- Take career aptitute tests online. Most of them don’t cost anything or have a free version to help you focus your interests.

If you have a broad range of talents and interests, see what jobs are most in need (nursing, electrician, teacher). Choosing a field of study that is in need of workers means job security when you graduate and possible industry specific financial assistance while you study. - Job shadow. See if you can shadow a parent, friend or family at work to see if the job fits with your interests.

Step 2: Choose a School based on…

- Location – Is it in a place where you want to study? Is it close to home? Far from home?

- Specialty – Choose a school that specializes in or has a good reputation in what you want to study.

- Cost – Many times, cost may outweigh the previous two options. Make sure you are getting the most for your money. What is your expected salary? Will an expensive college be worth the extra cost?

- Feeling – After visiting the college, how does it make you feel? How is the campus? It should make you feel safe and like a place where you can learn and grow.

Step 3: Pay for School

There are five main ways to pay for your education: out-of-pocket, work-study, loans, grants, or scholarships. If you fall under the middle three options, the first thing to do is complete a FAFSA application. FAFSA stands for Free Application for Federal Student Aid. FAFSA will let you know if you qualify for any federal grants, free aid money, like the Pell Grant, or which loans you qualify for.

Scholarships

There is a lot of free money out there. Here are some local resources to get you started:

University of Wisconsin System School Scholarships – General and degree specific scholarships

Wisconsin Private Colleges and University Scholarships

Wisconsin Technical College Scholarships

Bucky’s Tuition Promise – UW-Madison pledges to cover four years of tuition and segregated fees

for any incoming freshman from Wisconsin whose family’s annual household adjusted gross

income is $65,000 or less.

Need help applying for scholarships or working on other writing projects? Set an appointment with Madison Writing Assistance for free one-to-one writing help!

Money Smarts Kid’s Zone

Teach your little one from an early age that although money is printed from paper it doesn’t grow on trees.

Financial Literacy Mini-Workbooks | Fun activities to teach young children about money.

Financial Literacy Stories | Meet the Money Monsters from CFPB (Consumer Financial Protection Bureau)

Money Monsters Learn What Things Really Cost

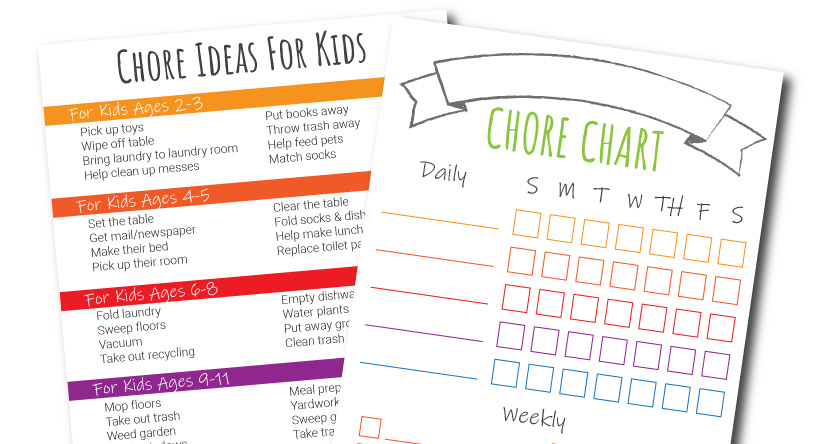

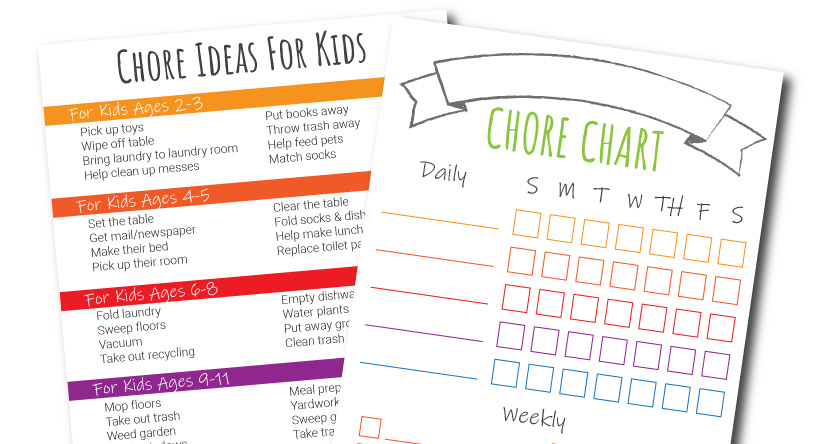

Chore Charts | Teach children the value of hard work and reward with a chore chart.

Youth Lessons Podcasts | Listen to CUNA’s (Credit Union National Association) Real Life 101 with Joe Chrysler while he discusses financial education tips for Kindergarteners, Middle Schoolers and High Schoolers.

Things to teach your Kindergartner about money.

Things to teach your Middle Schooler about money.

Things to teach your High Schooler about money.

- for Adults

-

Money Smarts for Adults

Here are some helpful resources to teach you about credit scores, budgeting, home buying and retirement planning.

What’s Your Money Style? – It’s helpful to understand how you and the people around you think about money.

Financial Literacy Webinar Recordings | Get financial insights from some of Madison’s leading experts in the industry. Listen to episodes, read key takeaways, and contact the speakers from our recent Financial Literacy webinar series. Topics: Cyber Security, Estate Planning, Home Buying Guide, Investing, and Retirement Planning.

Financial Literacy Webinar Recordings | Get financial insights from some of Madison’s leading experts in the industry. Listen to episodes, read key takeaways, and contact the speakers from our recent Financial Literacy webinar series. Topics: Cyber Security, Estate Planning, Home Buying Guide, Investing, and Retirement Planning. Balance Financial Counseling | As an MCU member you can receive free financial counseling through BALANCE. Get personalized budgeting help, review your credit report, prepare for buying a home, obtain identity theft solutions and more.

Balance Financial Counseling | As an MCU member you can receive free financial counseling through BALANCE. Get personalized budgeting help, review your credit report, prepare for buying a home, obtain identity theft solutions and more.

Just tell them Madison Credit Union sent you!BALANCE is a trusted financial counseling institution with over 45 years promoting financial wellness.

Click here to the BALANCE page or call now to get started: 888-456-2227.

Budget & Goals | Knowing where your money goes and where you want it to go for you in the future is a great place to get started on the road to financial freedom.

Budget & Goals | Knowing where your money goes and where you want it to go for you in the future is a great place to get started on the road to financial freedom.Check out our article on Simplifying your Budget with 4 Minimalist Techniques and download our Financial Goals and Budget Worksheet here.

Download our Bill Payment Calendar here.

Credit Scores | Everything you need to know about your credit report and credit score.

Credit Scores | Everything you need to know about your credit report and credit score. Check out our article 7 Tips for a Healthy Credit Score.

Retirement | Plan for your golden years with these helpful tools and articles.

Pre-Retirees: Avoid These 5 Real Estate Mistakes Getting ready to retire? Thinking about downsizing, refinancing or buying a second property? Read these 5 real estate mistakes to avoid first.

How to choose a retirement plan that works for you. This article includes all the ins and outs of a 401(k), IRA and Roth IRA.

Additional Retirement Links:

Retirement Calculator – Know how much you have to save to live how you want.

More from the IRS on Required Minimum Distributions (RMDs) – Know when and how much you need to remove from different retirement accounts.Play the Money Game | Learn while you play with this FDIC interactive game to help you learn about everyday financial topics. Click a topic below to go to the game.

Here are a few more financial tip articles. Click here to see a full list of Financial Education Blog Posts.

- for Young Adults

-

Money Smarts for Young Adults

Start your finances out on the right foot with these helpful resources

Off to College | How to choose a career path, pick a school, and pay for it

Step 1: Choose a Career Path

You can save a lot of money and time by knowing what you “want to be when you grow up” before heading into college. If you don’t already have an idea, here are some tips to get you started:- Make a list of your skills and strengths

- What previous working experiences have you enjoyed? What was it about them that you enjoyed (helping others, being social, etc.)?

- Don’t have any experience? Get an internship in a field of your interest.

- Take career aptitute tests online. Most of them don’t cost anything or have a free version to help you focus your interests.

If you have a broad range of talents and interests, see what jobs are most in need (nursing, electrician, teacher). Choosing a field of study that is in need of workers means job security when you graduate and possible industry specific financial assistance while you study. - Job shadow. See if you can shadow a parent, friend or family at work to see if the job fits with your interests.

Step 2: Choose a School based on…

- Location – Is it in a place where you want to study? Is it close to home? Far from home?

- Specialty – Choose a school that specializes in or has a good reputation in what you want to study.

- Cost – Many times, cost may outweigh the previous two options. Make sure you are getting the most for your money. What is your expected salary? Will an expensive college be worth the extra cost?

- Feeling – After visiting the college, how does it make you feel? How is the campus? It should make you feel safe and like a place where you can learn and grow.

Step 3: Pay for School

There are five main ways to pay for your education: out-of-pocket, work-study, loans, grants, or scholarships. If you fall under the middle three options, the first thing to do is complete a FAFSA application. FAFSA stands for Free Application for Federal Student Aid. FAFSA will let you know if you qualify for any federal grants, free aid money, like the Pell Grant, or which loans you qualify for.Scholarships

There is a lot of free money out there. Here are some local resources to get you started:University of Wisconsin System School Scholarships – General and degree specific scholarships

Wisconsin Private Colleges and University Scholarships

Wisconsin Technical College Scholarships

Bucky’s Tuition Promise – UW-Madison pledges to cover four years of tuition and segregated fees

for any incoming freshman from Wisconsin whose family’s annual household adjusted gross

income is $65,000 or less.Need help applying for scholarships or working on other writing projects? Set an appointment with Madison Writing Assistance for free one-to-one writing help!

- for Kids

-

Money Smarts Kid’s Zone

Teach your little one from an early age that although money is printed from paper it doesn’t grow on trees.

Financial Literacy Mini-Workbooks | Fun activities to teach young children about money.

Financial Literacy Stories | Meet the Money Monsters from CFPB (Consumer Financial Protection Bureau)

Money Monsters Learn What Things Really Cost

Chore Charts | Teach children the value of hard work and reward with a chore chart.

Youth Lessons Podcasts | Listen to CUNA’s (Credit Union National Association) Real Life 101 with Joe Chrysler while he discusses financial education tips for Kindergarteners, Middle Schoolers and High Schoolers.

Things to teach your Kindergartner about money.

Things to teach your Middle Schooler about money.

Things to teach your High Schooler about money.