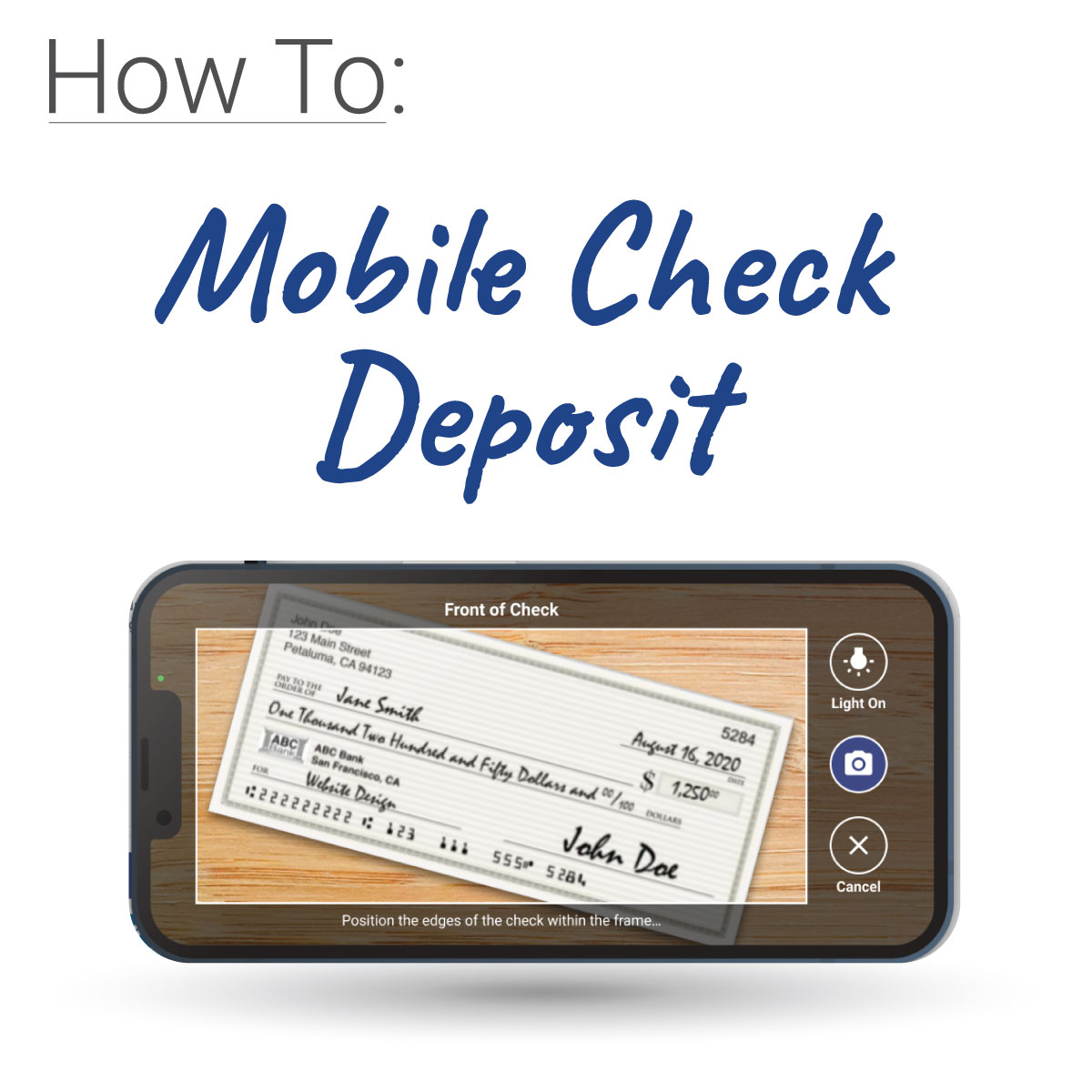

Mobile or Remote Check Deposit is easy with these How-to steps. Remote check deposit lets…

Tips to be Tax Return Ready

7 Tips to take the sting out of taxes

That oh so fun tax time is upon us and whether you plan to file yourself or work with a tax accountant, here are some helpful tips to make tax time a little more bearable.

1. Get all your documents in order

Grab any W-2s, 1099s, 1040s, 1095s, 1098s, 1010s, 314s (I made those last two up) but you get the point. There are numerous documents you need to file taxes, along with information (tax ID, social security numbers, etc.). It’s best to get everything in order before sitting down to fill out the paperwork.

- Print out this tax checklist from H&R Block to help you gather the necessary forms. Check it out here.

- Keep all the information that comes in the mail this month (W-2s, 1099s, bank statements, and mortgage interest statements). Even if the document doesn’t look important it’s best to holdout on recycling it until after you file your taxes.

- Gather any receipts and information that you have piled up during the year.

- Group similar documents together, bank statements with bank statements, etc.

- Make sure you know the price you paid for any stocks or funds you have sold. If you don’t, find out before you sit down to do your taxes.

- Know the details on any income from rental properties. Don’t assume that your tax-free municipal bonds are completely free of taxes.

2. Don’t forget those stimulus checks

If you received any stimulus payments in 2021 be on the lookout for a letter about your “Economic Impact Payments”. This will include information on how much you received in stimulus money including ‘plus-up payments’. Economic stimulus payments are not taxed but they still need to be reported on your 2021 taxes.

If you didn’t qualify for stimulus payments but your situation changed throughout the year you still may be eligible for recovery rebate tax credits on your 2021. Check here for more information from the IRS.

3. Itemize Your Deductions

Using the standard deductions can save you time, but itemizing deductions can save you money, especially if you are self-employed, own a home or live in a high tax bracket area.

It’s worth it to itemize when your 2021 qualified expenses add up to more than the standard deduction ($12,550 single, $25,100 married filing jointly). And remember you can deduct mortgage interest, charitable donations and the portion of any medical expenses that exceed 7.5% of your income for 2021.

4. Use the Home Office Deduction if You Can

The IRS has recently loosened home office deductions to apply to more self-employed filers. If you have no fixed location for your business and use the space exclusively for administrative or management activities you could qualify. And it could be worth your while. According to Turbo Tax, “a middle-class taxpayer who uses a home office and pays $1,000 a month for a two-bedroom apartment and uses one bedroom exclusively as a home office can easily save $1,000 in taxes a year. People in higher tax brackets with greater expenses can save even more”. Learn more here.

5. File Early & Request Direct Deposit

If you want your return processed quickly, e-file your taxes early. If you want your refund back quickly, choose direct deposit. The IRS estimates that if you e-file and choose direct deposit you can have your refund in approximately 21 days from the date you filed.

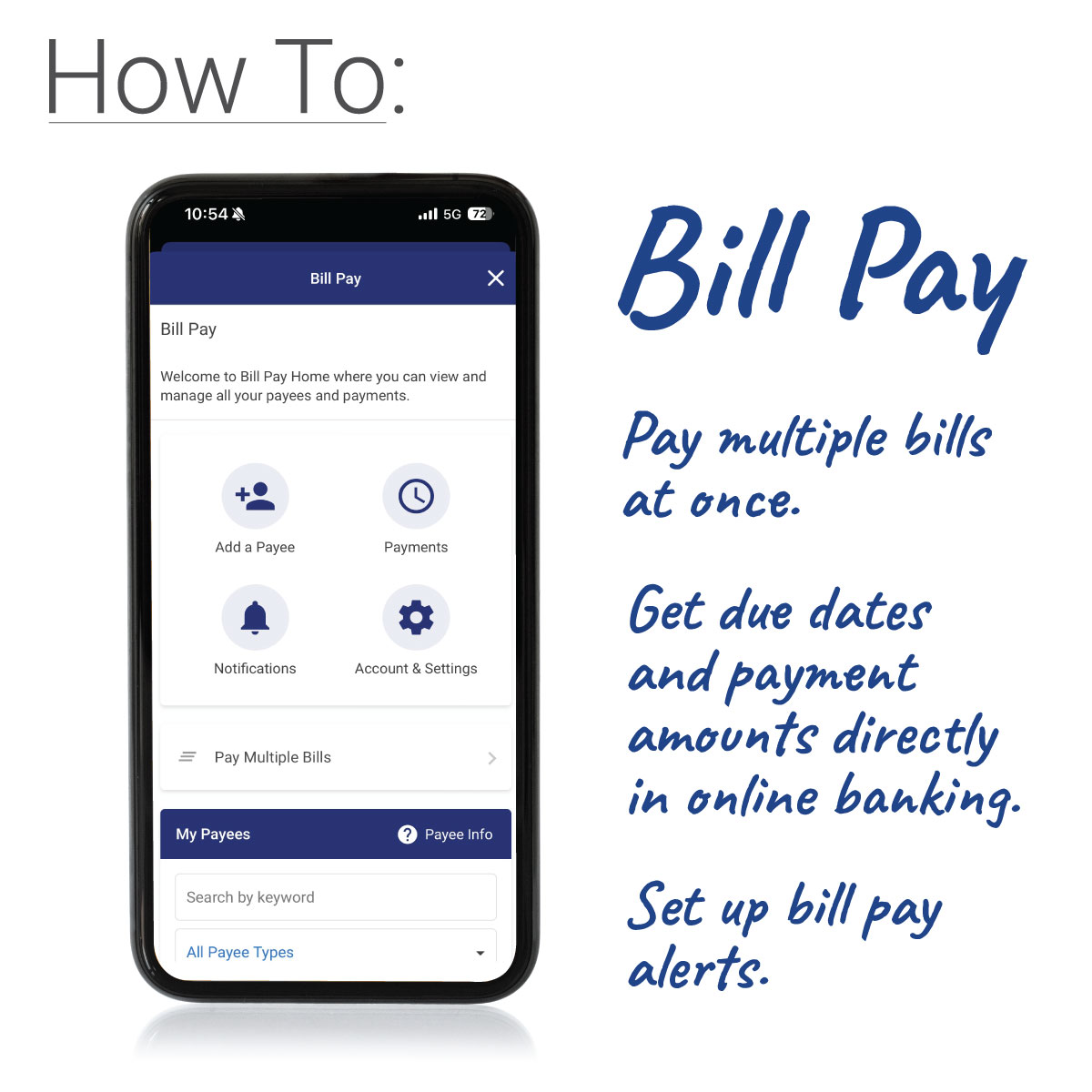

Direct deposit is a very safe and quick way to get your refund. You will need to provide the IRS with your bank’s routing number and account number. If you bank with MCU, you can find our routing number at the top of our website menu, just click the numbers and paste them where needed. Your account number can be found easily in online banking, our mobile app or an MCU check.

6. File an Accurate Return

6. File an Accurate Return

This seems like an obvious one, but it warrants mentioning. Especially with the stimulus payments and child tax credit payments, it’s important to make sure all the information entered on your return is accurate to avoid delays. So, make sure your paperwork includes all the latest numbers, then check and double check everything before filing.

7. Go Online for Help

If you are self-filing, instead of calling and waiting on hold for hours with the IRS, check out their online tools. Answers to most every tax question are available on their website 24 hours a day. Check them out here.

April 18th is the 2021 tax return deadline but if you can, it’s best to file early, not only may your return, and any refund, be processed faster, but you won’t have to worry about taxes for another blissful 12 months.

Sources:

https://turbotax.intuit.com/tax-tips/tax-planning-and-checklists/tax-tips-after-january-1st/L8fY6OyFl

https://www.irs.gov/newsroom/irs-begins-2022-tax-season-urges-extra-caution-for-taxpayers-to-file-accurate-tax-returns-electronically-to-speed-refunds-avoid-delays

https://www.hrblock.com/tax-prep-checklist/what-do-i-need-to-file-taxes/