Tax season can be overwhelming, but with the right information and preparation, it doesn’t have…

Where does the money go?

Running out of money at the end of every month?

Do you ever get to the end of the month, or near the end of the month and wonder where all your money went? If so, you are not alone. According to a 2020 Labor Survey from the US Bureau of Labor Statistics, Americans spend approx. 78% of their monthly budget on housing, transportation, food and taxes. That only leaves a meager 22% for clothing, health needs, personal care items, entertainment and investing for the future. Add housing shortages, inflation, and shrinkflation, and it’s no wonder so many of us aren’t finding extra money at the end of the month.

What can help, other than winning the lottery, is staying on top of your budget. Even just saying it sounds daunting. Budgeting is right up there with diet and exercise. It sounds good, we should probably do it, but it is so hard to stick to.

Plus, with spending happening in so many different places, it makes it even more challenging to stay on top of your budget. Amazon purchases with an Amazon credit card, debit card purchases at the grocery store, Kwik Trip card for gas purchases, points credit card for other purchases, checks for rent/mortgage, ACH withdrawals for child care, the list goes on.

Budgeting is tough and scary. Sometimes you don’t even want to know how much you’re spending. FYI, that doesn’t help… the money still disappears. There are also those months with unexpected expenses that you didn’t account for in your budget. Birthday gifts, Christmas gifts, car repairs, etc. Once the budget is blown for one month, it’s easy to scrap the whole process.

So, how about a compromise? A budget calendar. Write down all the due dates of bills and paychecks. And get all of the bills in there, rent, phone, utilities, credit cards, internet, etc. This will give you an idea of how much you are spending and when. If you do this for a few months, you can start to see patterns. For example, every month you spend approximately $100 on surprise expenses.

For a bonus, itemize your credit card bill, some companies will even do this for you. What are the subscription services that you are using? Do you really use all of them? Did you get that HBO subscription just to finish GOT and now keep paying for it but rarely use it? Cancel it. How much are you really spending at the grocery store? Could meal planning significantly cut those costs?

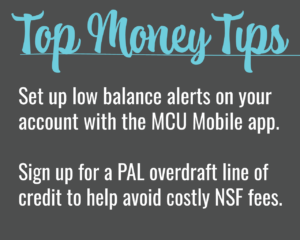

Madison CU can help too! We are here with all the right tools. All members are given access to free financial counseling (include budgeting) with BALANCE. Plus, anyone can find downloadable budget forms, links to money games, and more on our Financial Smarts page.

And if things are serious and money is so tight that you are starting to miss payments, please reach out to us. We can help. Payday lenders charge exorbitant fees and trap you in a cycle hard to get out of. We can work with you, we can find a way to help and if we can’t, we have resources that can. You are not alone in this.

Email us, lending@madisoncu.com. Our lending department has years of experience helping members purchase wisely and safely.