Tax season can be overwhelming, but with the right information and preparation, it doesn’t have…

Mortgage Protection Scams

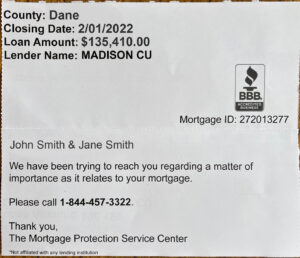

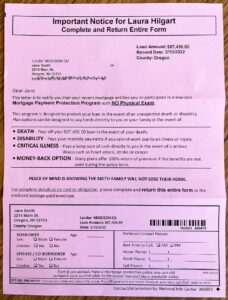

Mortgage Protection Insurance notices that appear to come from your lender

You just refinance your mortgage or purchase a home and within a few weeks you start receiving official looking, Important Notice, Final Notice letters that appear to be from your lender. They have your name, closing date, loan amount, and the name of your lender. The letters express a sense of urgency and in some, strong emotion such as, “Peace of mind knowing the [your last name] family will not lose their home.”

These are not letters from your lender. They are scams.

Scams to offer you mortgage protection insurance that they don’t actually cover.

If you took out a loan to buy your home or refinance on it, a Deed of Trust is drawn up, signed by the lender and buyer and then filed with the Register of Deeds for public record. These scam companies regularly search the Register of Deeds records and any newly recorded deed is likely to start receiving these kinds of mailing.

Please discard them. Here are samples that our own employee has received since refinancing their loan.

Madison Credit Union, nor any other reputable lender will send you documents such as these.

However, Mortgage Protection Insurance (MPI) is a real thing. It can help pay off your mortgage if you were to pass away or offer short-term payment protection if you become disabled. This is different from Private Mortgage Insurance (PMI) that protects your lender if you default on your loan.

There are benefits and cons for Mortgage Protection Insurance. Standard life insurance can offer your family more security and flexibility in the long run than a Mortgage Protection Insurance. Here’s an article that can help you decide if MPI is worth it: https://www.nerdwallet.com/article/insurance/mortgage-life-insurance

And remember, if you receive something that you are unsure about, call your lender directly. Don’t call the number on the letter or mail them any more of your information. Your lender will happily clear up any confusion.

If you think you’ve been scammed, visit USA.gov for tips to see if you can get back any lost money and how to report the scam.