Tax season can be overwhelming, but with the right information and preparation, it doesn’t have…

Debit Card vs Credit Card: The Pros and The Cons

Cash is still a popular way to pay for services and goods, and can sometimes even secure you a discount, but cards, either debit or credit, can be more convenient. A recent study done by Capital One Research says that cash is used in only 12% of U.S. in-store transactions. Even at the local farmers market you don’t need cash anymore as most vendors accept debit or credit cards.

Since so many purchases are made by credit and debit cards, it’s important to know the pros and cons of each.

Debit Cards: Pros

A convenient way to access your cash without carrying it around with you. It’s easier to carry around one card than a bunch of cash and coins.

A convenient way to access your cash without carrying it around with you. It’s easier to carry around one card than a bunch of cash and coins.

Debit cards can help you stay within your budget. Since debit cards are connected directly to your checking account, it means you can’t spend money you don’t have.

They don’t charge interest. Since you aren’t borrowing any money, there is no interest to pay.

Debit card round-up programs. Some financials, like Madison Credit Union, offer debit card round-up programs. These programs allow you to round-up a purchase to a whole dollar amount and moves the spare change portion to a savings account. All that change can start adding up!

Debit Cards: Cons

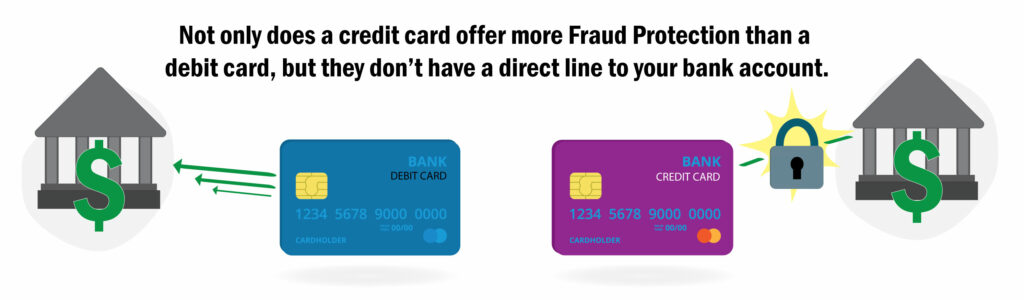

Less fraud protection. This is a BIG con. Debit cards don’t have the same fraud protection as credit cards and they are a direct connection to your checking account. Because of this fact, it is NOT recommended to use your debit card for online purchases.

Debit cards do offer some fraud protection. If you report an unauthorized purchase on your debit card within two business days, federal law limits your liability to $50. If it’s after two business days but before 60 business days, you could be liable for up to $500 and if you don’t report it until after 60 business days, you could be liable for the whole amount. Even if you get the money back, it may still take time.

Madison CU has a more generous debit card fraud program. We allow you until the 60 business days to inform us of fraudulent activity and we generally refund you the entire amount right away. We don’t wait to try to get the money back first, before refunding it to you.

There are many instances of consumer inconvenience that are not considered fraud. Fraud protection doesn’t apply if:

- You give your PIN and debit card to someone to use and they buy more than you meant for them to.

- Don’t read the fine print of a website and accidentally agree to charges you didn’t mean to accept.

- A company ships you an item that you intentionally bought but never received.

- You purchased a defective item and the company won’t refund your money.

If you had made the above purchases with a credit card, you would have had more recourse to refute a purchase.

Some businesses put holds on funds. Some gas stations, rental car companies, and many hotels will put a hold of anywhere from $50 to up to $200 on your card. For those with low balances, this could prevent other purchases you made from going through and could end up in overdraft instances.

It’s possible to overdraft. Depending on where you bank, and the type of account you have, it is still possible to overdraft with a debit card if you don’t keep close track of your account balance. Overdraft consent allows the purchases to go through but then charge a fee. Even if your bank doesn’t charge overdraft charges, they may deny the payment and then still charge a returned check/ACH fee.

Credit Cards: Pros

Lots of perks. While a specific bank may only have one debit card, they may have five or more different credit cards to choose from. There are cashback cards, travel rewards cards, zero APR balance transfer cards, and then there are the store specific cards, ie. Costco, Home Depot, Kohl’s, etc. Each card has specific perks to fit your needs. Debit cards tend to not offer many rewards.

Can help build credit. When used smartly, credit cards are a great way to help build your credit. Better credit means you can get a better rate on other loans like cars and houses.

Credit cards offer robust fraud protection. The Fair Credit Billing Act caps a card user’s liability at $50 for fraudulent charges. Your credit card can also save you from bad consumer experiences. If you purchased a defective product from a seller or purchased something that never arrived, you can contest the payment with your credit card company and may not have to pay. Credit cards are also not a direct connection to your bank account so it adds an additional layer of protection, especially for online purchases when you could be inputting your information on a compromised website.

Credit Cards: Cons

Some credit cards will charge an annual fee. It tends to be the cards with the most perks that charge an annual fee. However, if you use the card enough that the perks you earn more than pay for the annual fee, it still might be worth it.

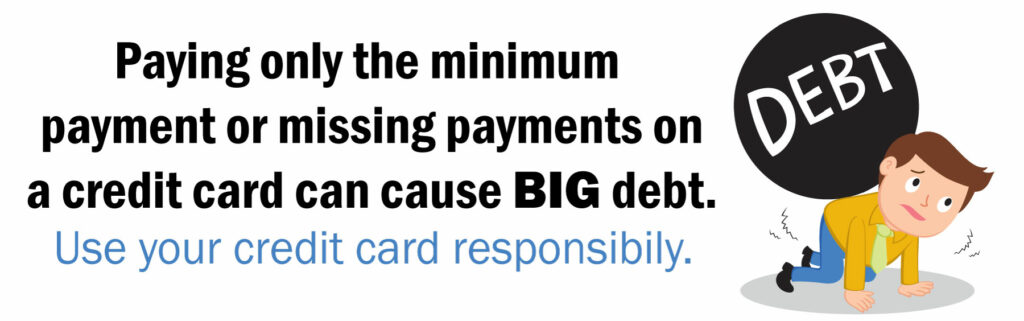

If you don’t pay your card balance in full you will get charged interest. Credit cards provide you with a line of credit. That credit, if not monitored carefully and paid often, can result in high interest and late fees, which can lead to a high-interest, debt spiral.

They can allow you to spend more than you can afford. Your credit limit may be higher than what your budget can handle. And since you don’t have to pay the full balance every month, it might be easier to let spending get out of control. Just as credit cards can help your credit score, they can also hurt it if not handled responsibly.

Which Card to Use Where?

USE CREDIT CARDS FOR:

All online and telephone purchases. The added fraud protection credit cards offer and the fact that they are not directly tied to your bank account, is key to cyber safety.

Hotels, rental cars, and gas if you have very low balances in your checking account.

For the perks if you can manage to pay off the balance right away.

USE DEBIT CARDS FOR:

Small everyday purchases.

As a more convenient alternative to cash.

When you need help staying on budget.

Last Nuggets of Insight

Credit cards are amazing tools to use to earn rewards, including cashback, on money that you were going to spend anyway. They also offer a lot more security than any other method of payment out there. You just have to be careful how you use them.

If you struggle to stay on budget but still want the benefits and security of a credit card, you can make a payment as soon as you make a purchase. You don’t have to wait until the bill comes.

Monitor your accounts often. Keeping an eye on your spending can help you stay within your means and can help you catch fraudulent activity right away.

If you have any questions about fraudulent charges, please call us at: 608-266-4750 or send us an email: creditunion@madisoncu.com.

Looking for a credit card with lots of perks. Check out one of our MCU – Elan credit cards here. There are eight cards to choose from with benefits like travel rewards, cashback rewards, balance transfers, college bound.